44+ how much of my income should go to mortgage

And you should make. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

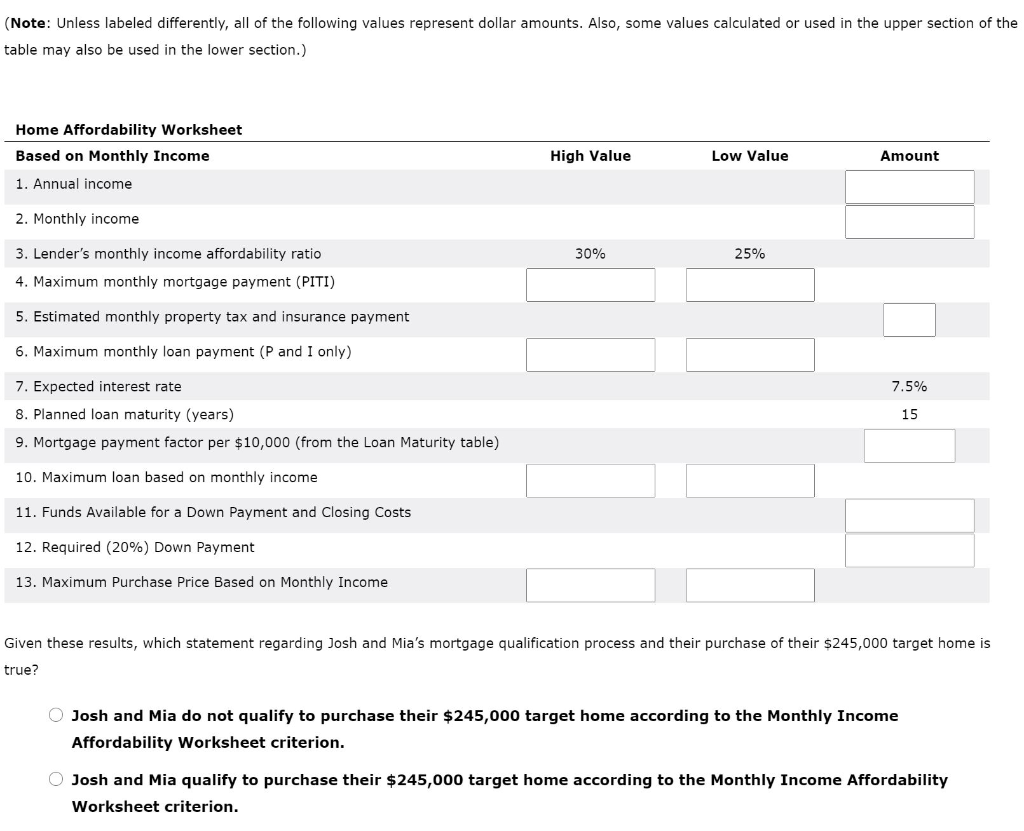

Solved Can Josh And Mia Afford This Home Using The Monthly Chegg Com

Ad See how much house you can afford.

. Ad Americas 1 Online Lender. Compare Rates Get Your Quote Online Now. Were not including any expenses in estimating the.

Debt to income ratio 3485 divided by 10000 03485 3485 or 35 just under the suggested maximum. Banks with total assets of at least 10 billion and removing purer investment banks such as Goldman Sachs Group Inc. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Web 2 days agoStarting with a list of US. This means your monthly payments should be no more than 31 of your. Take the First Step Towards Your Dream Home See If You Qualify.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. Compare Apply Directly Online. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Compare Lenders And Find Out Which One Suits You Best. Check Your Official Eligibility Today. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment.

Comparisons Trusted by 55000000. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Looking For a House Loan.

Use NerdWallet Reviews To Research Lenders. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Take Advantage And Lock In A Great Rate. Comparisons Trusted by 55000000. Ad 5 Best House Loan Lenders Compared Reviewed.

Estimate your monthly mortgage payment. The 3545 Rule The 3545. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. This rule says that you should not spend more than 28 of. Compare Rates Get Your Quote Online Now.

This means that if you want to keep. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad 5 Best House Loan Lenders Compared Reviewed. Ad Updated FHA Loan Requirements for 2023. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Calculate Your Payment with 0 Down. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Keep your total debt payments at or below 40 of your pretax. John in the above example makes. Compare Lenders And Find Out Which One Suits You Best.

Ad Americas 1 Online Lender. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Total monthly household income before tax 10000.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Looking For a House Loan. Web With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability.

Free 10 Mortgage Payoff Statement Samples In Pdf

How Much Of My Income Should Go Towards A Mortgage Payment

Mortgage Broker Taree Forster Better Loan Rates Mortgage Choice

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator

What Is A Mortgage Credit Carrots

What Percentage Of Your Income Should Go To Mortgage Chase

Loan Proposal 13 Examples Format Pdf Examples

2 Carrico Road Florissant Mo 63034 Compass

Percentage Of Income For Mortgage Payments Quicken Loans

What Percentage Of Income Should Go To A Mortgage Bankrate

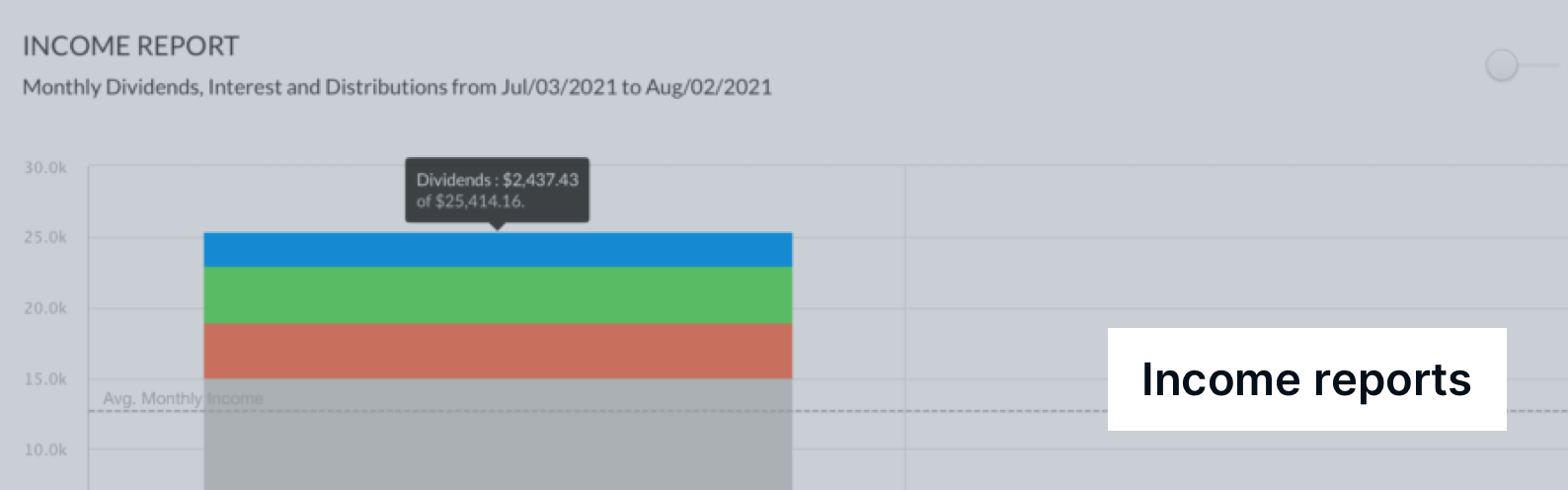

Wealthica Archives Journey To 100b Wealthica

Rqcj 1quo Rhlm

What Percentage Of Income Should Go To A Mortgage Bankrate

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

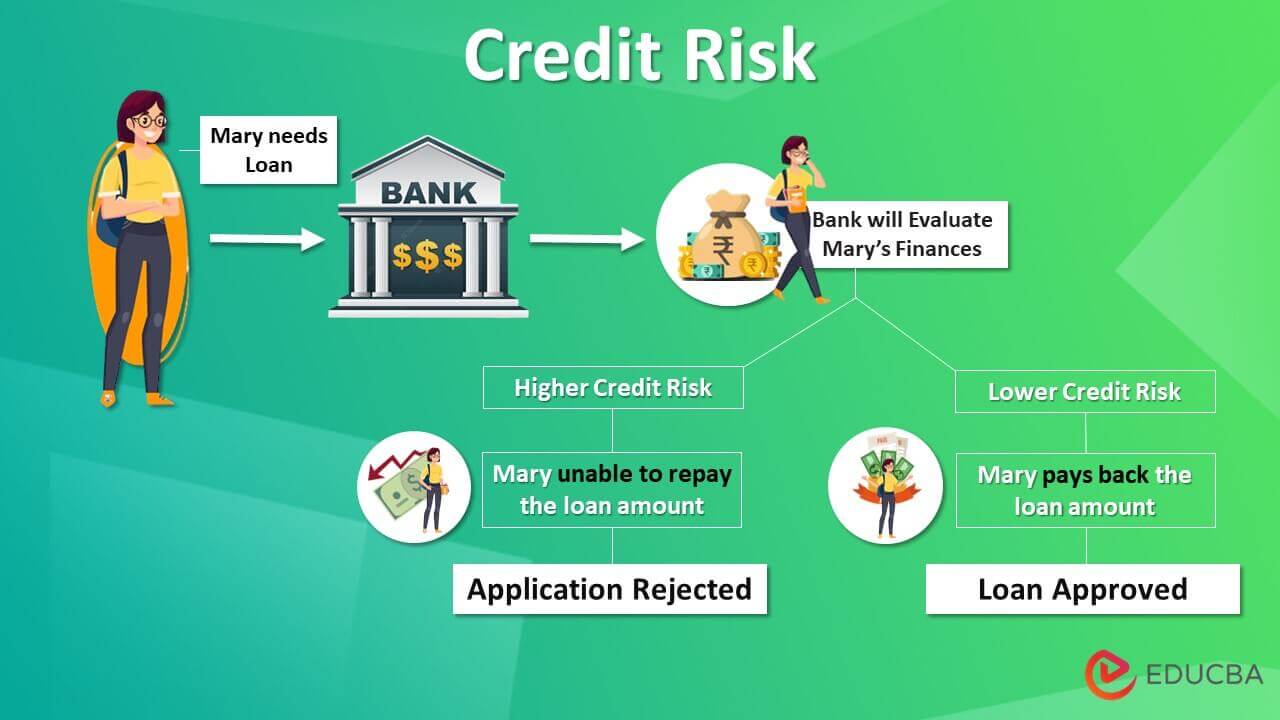

Credit Risk How To Measure Credit Risk With Types And Uses

What Is Fannie Mae Purpose Eligibility Limits Programs